Leaders in Business Process Automation | +61 2 8228 6600

Leaders in Business Process Automation | +61 2 8228 6600

Is your Accounts Receivable department spending too much time manually allocating and reconciling cash in your ERP? The Aberdeen Group reports that improving cash flow projections and reducing Days Sales Outstanding (DSO) are the two greatest pressures facing accounts receivable teams today. After all, reducing the time for DSO means bringing in revenue faster – the ultimate goal of any company and Accounts Receivable team.

Reduce manual work and errors by automating data capture, cash allocation and exception handling

Decrease Days Sales Outstanding (DSO) and Accounts Receivable costs by eliminating data entry and bank fees, and reducing unallocated payments and open items

Enhance customer service and maximise revenue through the timely clearing of payments

Performance reports enable increased productivity and the ability to identify and troubleshoot issues quickly

Automate the manual processes of matching remittance advice information with invoices and reconciling them in your ERP to positively impact your bottom line. By reducing manual payment allocation, eliminating bank fees, allocating cash more quickly and improving visibility, your accounts receivable department will operate more efficiently and cost-effectively while improving customer service.

Our Accounts Receivable automation solution can automatically:

When you replace manual work with best-practice automated processing in Accounts Receivable, you reduce costs, improve cash flow and cash flow forecasting, and drive greater Order-to-Cash processing performance.

Tungsten TotalAgility is a flagship solution that combines a native mix of interoperable automation technologies and artificial intelligence to make information-intensive business processes more efficient, more precise and faster. It allows you to automate accounts receivable processes, accounts payable processes and much more with a single platform.

|

|

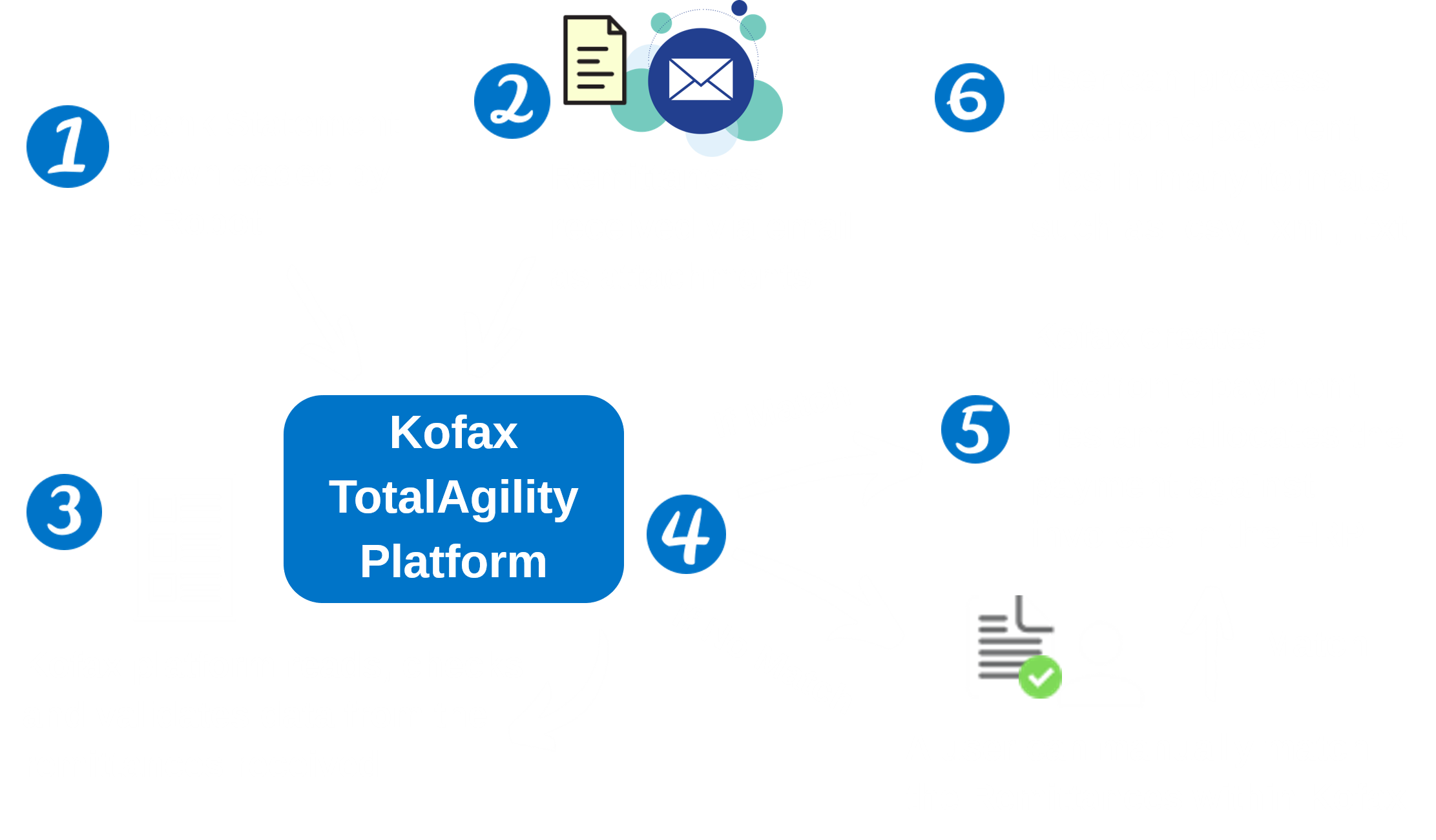

A Robot downloads the Bank statement |

|

|

|

Remittances received via email as an attachment |

|

|

|

Tungsten TotalAgility reads, checks and retrieves data from the remittances to match payments |

|

|

|

If the transaction matches, Tungsten TotalAgility creates electronic payment files and saves them into the ERP. If there is no match, human assistance is required to match the remittances |

|

|

|

Tungsten TotalAgility creates electronic payment files and allocates the payment against invoices in the ERP |

|

|

|

Users can process electronic payment files in many formats such as .csv, .xml, .txt, .api |

Enable the transformation from physical to fully digital interactions in any key business process.

Deploy intelligent business processes to greatly reduce costs. Increase the efficiency of all interactions and enhance the productivity of workers through automation.

Digitise paper for better access and compliance.

Create business value at every customer engagement touch-point. Reduce cost, while handling greater volumes of transactions.

Don't miss this exclusive opportunity to learn how to leverage the power of accounts receivable automation to transform your business.

Download this ebook to learn how organisations can employ intelligent automation to deliver superior service, keep costs in check and optimise operations.

Cost and efficiency are only part of the story when it comes to understanding where and how organisations prioritise automation.

Director - Strategic Financial Solutions

The solution provided by Xcellerate IT went above and beyond our initial expectations and allowed for the future development. This opened the doors to other financial processes beyond AP, such as payroll and HR forms.

The Xcellerate IT solution has been cost-effective since day one.

Financial Accounting Manager

The Xcellerate IT solution represents one of the best ‘Value for Money’ technology advancements undertaken in recent times by Council.

Staff time savings and increased job satisfaction are significant.

Team Leader Accounts

Invoices are now paid faster and suppliers are therefore happier.

We now spend less time on data entry, searching through paper files and answering internal and external queries. Invoices now come straight to one central point.

Assistant Director Finance

Xcellerate IT was very flexible and provided assistance to ensure the project implementation was achieved on time and below budget.

Finance Manager

The introduction of Xcellerate IT’s solution has revolutionised our accounts payable operations and there is still great potential for further advancement in workflow processing.

Finance & Tax Accountant

Xcellerate IT’s solution has provided quantifiable efficiencies and savings, and the support of our consultant through the whole implementation process was, and continues to be, excellent.

Finance Operations Manager

This is something we never thought possible!

Senior Financial Systems Manager

Financial Services Team

We’ve been a Kofax customer for eleven years …

The product is brilliant, easy to use and incredibly accurate.

This is a fantastic innovation.

Terms of use . Privacy Statement . Blog Articles . Legal

Copyright © 2025 Xcellerate IT

Brand & Website by Thought Balloon Creative